Navigating Account Migrations: Key Considerations for Singapore SMEs

For Singapore SMEs, account migrations are crucial to improving operational efficiency, enhancing financial reporting, and keeping up with evolving business needs. Whether upgrading accounting services, switching providers, or moving to cloud solutions, a successful migration is key to maintaining financial accuracy and regulatory compliance. In this blog, we’ll explore the essential considerations for Singapore SMEs when navigating account migrations.

1. Selecting the Right Migration Provider for Singapore SMEs

Choosing the right migration provider is one of the most important decisions when undergoing an account migration. Here’s what to look for when evaluating potential providers:

- Experience: Ensure the provider has experience managing migrations for businesses of your size and industry, with a clear understanding of local regulations.

- Tailored Solutions: A solution that fits your business’ specific needs—such as handling multi-currency transactions or automated tax calculations—is vital.

- Clear Communication: A provider should offer transparent timelines, regular updates, and clear expectations throughout the migration process.

Example:

For a Singapore SME in retail, selecting a provider with experience in handling high transaction volumes and stock management will ensure a seamless migration of your accounting system, keeping track of sales, stock levels, and expenses.

2. Ensuring Data Security During Account Migrations

When migrating financial data, security is paramount. Sensitive financial information needs to be protected at all costs to avoid cyber threats or data breaches. Here’s how to ensure your data remains secure:

- Encryption: Ensure all data being transferred is encrypted, preventing unauthorised access during the migration.

- Cloud Security: If migrating to a cloud-based system, check that the cloud provider adheres to strict security protocols.

- Access Control: Post-migration, ensure the new system has proper user access controls to restrict sensitive data access.

Example:

For a Singapore SME in the e-commerce sector, migrating customer payment details and transaction histories requires robust encryption protocols to safeguard against data breaches during the migration process.

✅ At Counto, we prioritise your bottom line. Our expert accountants deliver comprehensive services—from bookkeeping to tax filing—at transparent rates. Explore our all-in accounting plans and keep more of what you earn.

3. Complying with Local Regulations During Account Migrations

Regulatory compliance is non-negotiable. Any account migration must meet the requirements set by Singapore’s regulatory bodies to avoid penalties or disruptions. Key considerations include:

- IRAS Compliance: The accounting system must be able to handle GST filing, tax calculations, and ensure e-filing capabilities as per Inland Revenue Authority of Singapore (IRAS) guidelines.

- ACRA Compliance: Ensure the system supports accurate financial reporting and is ready for audits as per Accounting and Corporate Regulatory Authority (ACRA) standards.

- Tax and Legal Framework: Ensure that the new system complies with local tax laws and is ready for any legal audits.

Example:

For a Singapore SME dealing with both local and international sales, it’s crucial that your migration system accurately tracks GST, ensuring compliance with IRAS requirements for both local and cross-border transactions.

4. Customisable Solutions for Singapore SMEs

Every business has unique financial management needs, so finding a customisable accounting solution is essential. Avoid one-size-fits-all solutions and look for flexibility in the following areas:

- Scalability: The system should grow with your business, accommodating additional users, increased transactions, or more complex financial needs as you expand.

- Industry-Specific Features: A good provider will offer features tailored to your industry, such as inventory management for retailers or multi-currency support for international businesses.

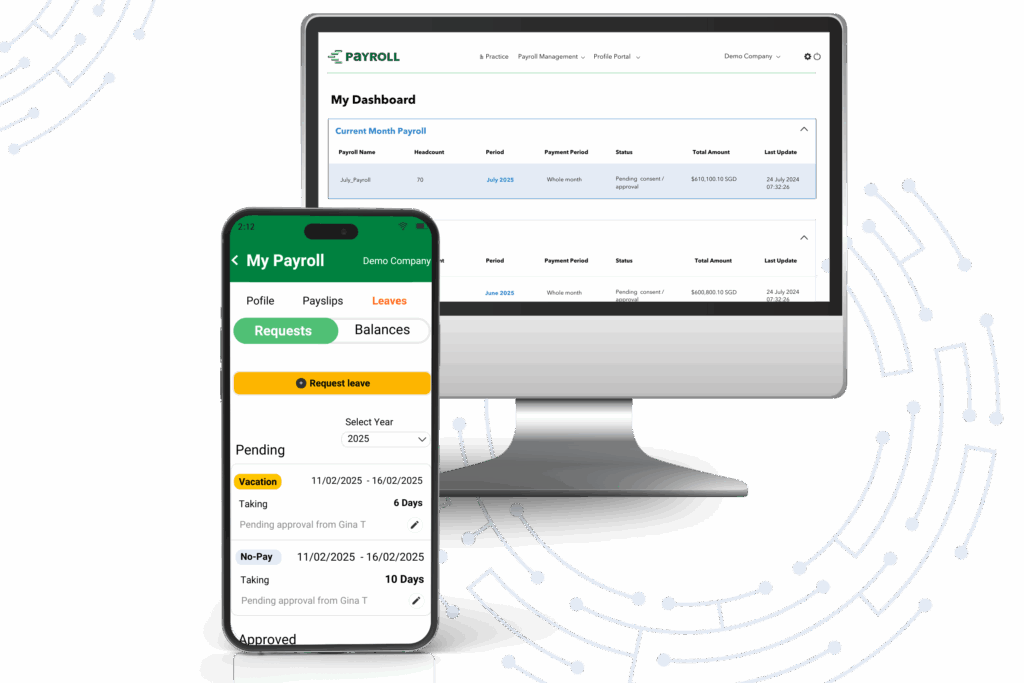

- Integration: Ensure the system integrates seamlessly with your other business tools, such as payroll systems, inventory management, and sales tracking.

Example:

For a Singapore SME in manufacturing, migrating to a system that integrates accounting with inventory management ensures that stock levels are always accurately reflected in financial reports, making data collection and reconciliation more efficient.

5. Post-Migration Support for Singapore SMEs

The migration process doesn’t end once the new system is live. Ongoing support is critical to maintaining smooth operations. Key aspects of post-migration support include:

- Training: Your team must be trained to use the new system effectively, ensuring that they understand how to generate reports, track transactions, and manage financial data.

- Ongoing Support: Ensure that the provider offers technical support in case of issues with the new system after migration.

- System Maintenance: Regular updates and maintenance should be part of the service, ensuring that the system continues to run efficiently and remains compliant with changing regulations.

Example:

After migrating to a new accounting platform, your finance team will need training on how to use the system for tasks like tax filings, generating financial reports, and reconciling accounts. Having access to ongoing support will ensure that any issues are promptly addressed.

Summary

Successfully managing an account migration can significantly improve financial management for Singapore SMEs. By carefully selecting the right provider, ensuring data security, complying with regulations, choosing a customisable solution, and securing post-migration support, businesses can ensure a smooth transition to more efficient accounting systems. This process isn’t just about adopting new technology—it’s about enhancing your business’s financial accuracy, compliance, and operational efficiency.

Experience the Counto advantage

Counto is the trusted outsourced provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price. To learn more, speak to us directly on our chatbot, email [email protected], or use our contact form to get started.

Here are some articles you might find helpful: