IRAS GST Tax Invoice Requirements: Essential Guide for Business Owners in Singapore

For small business owners in Singapore, understanding and complying with the Goods and Services Tax (GST) requirements set by the Inland Revenue Authority of Singapore (IRAS) is crucial. This post shows what you need to know about GST tax invoices to ensure compliance and avoid any pitfalls that could impact your input tax claims.

What is a GST Tax Invoice?

A GST tax invoice is a document that GST-registered businesses must issue when making taxable sales. It is essential for both charging GST on sales and claiming input tax credits. This invoice serves as the main document for supporting input tax claims that your customers might make for their standard-rated purchases.

Key Requirements for a Valid GST Tax Invoice

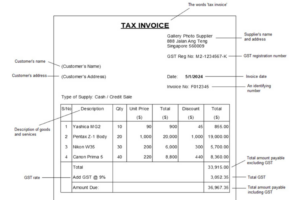

To comply with IRAS regulations, a GST tax invoice must include:

1. The phrase “Tax Invoice” prominently displayed.

2. Supplier’s details: Name, address, and GST registration number.

3. Customer’s details: Name and address.

4. Invoice specifics: Unique invoice number and the date of issue.

5. Details of the transaction:

- Description of goods and services provided.

- Total amount payable excluding GST.

- GST rate applied and the GST amount charged.

- Total amount payable including GST.

6. Currency considerations: For invoices issued in foreign currencies, the equivalent amount in Singapore dollars (SGD) must also be included, using approved exchange rates.

See below for an example of a tax invoice:

Source: Inland Revenue Authority of Singapore (IRAS)

Retention of Tax Invoices

Both issued and received tax invoices must be retained for at least five years, even though they do not need to be submitted with your GST returns. This retention is vital for documentation purposes and compliance with audit requirements.

✅ Let Counto’s tax specialists handle Singapore’s tax complexities for you. Our comprehensive accounting plans seamlessly integrate GST filing—no extra fees, just straightforward expertise. Explore our plans here.

Issuing Tax Invoices

You must issue a tax invoice within 30 days from the time of supply for all standard-rated supplies if your customer is GST registered. This allows them to claim input tax on their purchases. It is important to note that tax invoices are not required for zero-rated supplies, exempt supplies, deemed supplies, or transactions with non-GST registered customers.

Simplified Tax Invoices for Transactions Under $1,000

For transactions not exceeding $1,000, a simplified tax invoice can be issued. This needs to include fewer details: supplier’s name, address, GST registration number, date of issue, a description of goods or services, and the total amount payable including GST.

Calculating GST on Tax Invoices

When calculating GST, you can either:

- Apply the current GST rate (e.g., 9%) to the value of each item before summing up the GST for each item, or

- Apply the GST rate to the total amount payable excluding GST for all items combined.

Both methods are acceptable, but you must choose one method and use it consistently.

Rounding Off GST Amounts

IRAS allows rounding off the total GST amount on the invoice to the nearest cent. When dealing with cash transactions, the total bill (including GST) can be rounded to the nearest 5 cents to facilitate cash payments, but your rounding method must be consistent.

Summary

Compliance with GST tax invoice requirements is not just about following rules—it’s about Adhering to the GST tax invoice requirements set by IRAS is crucial for all business owners looking to claim input tax credits.

Missing or incomplete invoice details can lead to the rejection of such claims, impacting your business’s financial health. Ensure that your invoices, as well as those from your suppliers, comply fully with these guidelines to maintain smooth financial operations and prevent any issues.

For more detailed information, please refer to the official IRAS GST Invoicing Guidelines.

Experience Singapore’s Most Trusted Accounting Service

Counto empowers small businesses like yours to save time and money year-round. Enjoy direct access to a dedicated Customer Success Manager, backed by trusted accountants and tax specialists. Talk to us on our chatbot, email [email protected], or contact us using this form.

Here are some articles you might find helpful: